Detailed Notes on chapter 7 bankruptcy

The thought of liquidation can be overwhelming, since it conjures photos of getting rid of all the things just one owns. Nonetheless, not all property are up for grabs in Chapter seven. Exemptions Perform a crucial job, safeguarding necessary goods for primary residing and employment. It’s necessary to comprehend these protections to navigate Chapter seven successfully.

Whether you'd probably lose your tax refund relies upon upon whether or not you will have the capacity to exempt the amount you predict to obtain. There are numerous variables that Engage in into this query, and it ought to be talked over with capable, community bankruptcy counsel.

The complex storage or entry is essential for the legit reason of storing Choices that are not asked for because of the subscriber or user.

Inquire a question about your monetary problem furnishing just as much detail as you can. Your information is held secure and never shared Except you specify.

Aspect of the tax refund will grow to be Portion of the bankruptcy estate along with the trustee will utilize it to pay for creditors.

For those experiencing chapter seven bankruptcy, though, keeping the money received from their tax refund is not really generally certain. Generally, the willpower on regardless of whether you maintain your tax refund or not is manufactured depending on the timing of each your receipt of that refund and when you file for bankruptcy, but there are a few methods that can help make sure you can get to about his help more info here keep your money.

The easiest method to stay away from getting rid of your tax return for your trustee and creditors is usually to strategy ahead. Even though it could be tough to plan your bankruptcy filing significantly in advance, the lengthier out you’re able to predict and prepare for items, the higher. 3 ways to hang on to your money by mindful timing and preparing incorporate:

If you're able to hold out to file until finally immediately after you receive your refund and devote it you should. Tax refunds are non-exempt property the trustee will choose. Exception is for Gained Profits Credit and Child Tax Credit history of line fifty of form 1040, which are exempt.

They will let you comprehend the probable procedure within your tax refund and discover methods to safeguard it, guaranteeing that you choose to’re making informed decisions regarding your financial potential.

This is an evidence for a way we look these up earn cash . Our Bankrate assure is to be certain almost everything we publish is goal, exact and trustworthy.

All of our written content is authored by remarkably competent specialists and edited by subject material experts, who be certain everything we publish is aim, accurate and reliable. Our banking reporters and editors concentrate on the details individuals care about most — the most effective financial institutions, hottest prices, differing types of accounts, funds-saving ideas and even her latest blog more — so that you can really feel self-assured as you’re running your cash.

Our mission is always to empower viewers with by far the most factual and trusted financial facts feasible that can help them make educated conclusions for his or her person demands.

Here's an evidence for the way we earn a living . Our Bankrate guarantee is to be sure all the things we publish is objective, precise and reliable.

Recognize what bankruptcy can perform for you: Every single household’s money problem differs. We overview your money picture and allow you to know if you qualify More Bonuses for bankruptcy in Virginia.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Mara Wilson Then & Now!

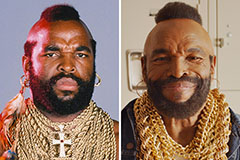

Mara Wilson Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!